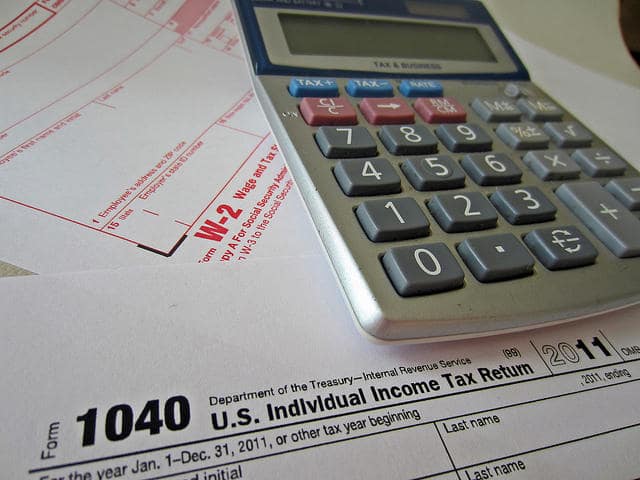

Preparing for Your Tax Return

Tax return time can be a good or hard time of the year, depending upon just how you have actually handled your finances– for some it can be like a small lotto win, as well as for others it can indicate a large bill. The result does not have to be entrusted to chance. By knowing how to manage your income, and what you’re investing in, purchasing and contributing to, you can make certain that you get a cheque, instead of publish one in July.

Tax obligation accounting professionals are an excellent help when it comes to preparing yourself for tax obligation time. Make a visit with your accounting professional and seek advice regarding the very best methods to enhance your tax return– discover what is tax insurance deductible, what is a cross out and what will certainly increase the tax you need to pay.

Just how to take advantage of your income tax return

– Claim whatever you can. Recognize all the normal areas you can declare on, especially as they refer to your task. Know if you can claim laundering solutions, stay on top of any prices you might incur as a result of using your vehicle for job (you will need to make use of a log book for this), as well as use of your individual phone or web. Several of these amounts can be challenging to figure out, the Australian Tax Workplace internet site can aid, and your accountant will certainly additionally have the ability to discuss just how it operates in information.

– Education and learning. Part of the expense of education you take on that relate to your job can be asserted, as can sector publications or publications that assist you execute or recognize even more about your market. The information on what you can claim get on the ATO website– guarantee you do not lose out on a beneficial claim by failing to remember education and learning expenses.

– Sideline or freelance job. In some cases we embark on job that is not our usual work– such as freelance writing, mowing yards or various other contracting or temporary job. If your employer isn’t keeping your pay as you go tax, ensure you make voluntary repayments so you do not obtain a costs at the end of financial year. Find a good accountant Perth in this link.

– Normal voluntary repayments. Do you have trouble conserving? Voluntary settlements can be a fantastic means to conserve additional money by putting it somewhere you have no access it for the whole year. Speak to your HR or payroll group and ask them to take an extra quantity of tax obligation out each pay day, so when July rolls around you will not only not receive an expense, however likely, will obtain a remarkable cheque.

– Charitable donations. Contributing to charity is a wonderful thing to do, understanding you’re helping people in challenging circumstances is extremely rewarding. Donations are also rewarding at tax obligation time due to the fact that they are tax obligation deductible. Ensure you get an invoice for all donations and have it readily available when filling in your tax return.

Most importantly, the most effective means to maximize your income tax return is to work with a professional tax obligation accounting professional to complete your return. Accounting professionals are fully aware of everything you can deduct as well as assert for, and also while you pay for their solutions, you stand to owe a great deal much less, or possibly gain a great deal extra.